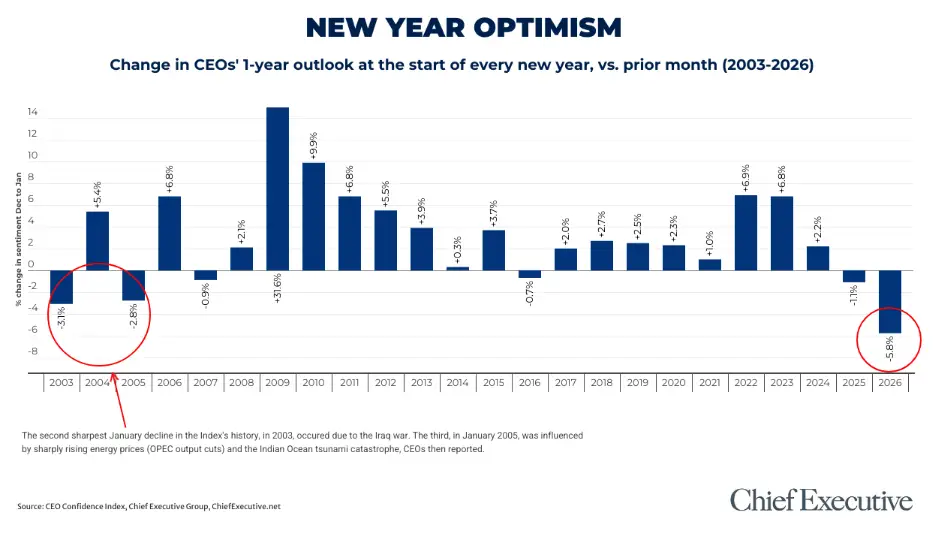

CEO Confidence Falls On Washington Uncertainty In Sharpest January Decline Since 2005

Summary

Chief Executive’s January survey of 250+ US CEOs (fielded Jan 13–14) finds a rare and sharp drop in executive sentiment to start 2026. The CEO Confidence Index fell on measures of current business conditions and trimmed expectations for year-end improvement. Key drivers: political uncertainty tied to the Trump White House, higher interest-rate and capital-cost concerns, and persistent cost pressures.

Key Points

- Current business conditions score fell to 5.5/10 in January from 6.0 in December (an 8% decline).

- CEOs now expect year-end conditions to be 6.0/10, down from a previous projection of 6.4.

- Political uncertainty in Washington — especially related to President Donald Trump’s administration — is the principal concern cited by most CEOs.

- Interest rates, cost of capital and rising operating costs are constraining planning and margin strategies.

- Despite caution, 76% expect revenue increases and 67% expect improved profitability; 45% plan higher capital expenditure (up from 42%), and 53% plan headcount expansion (up from 46%).

- Only 15% expect a recession in H1 2026, while 57% anticipate economic growth; nevertheless, nearly half name the US economy as their top business risk.

- Operational focus for many CEOs is on achieving target profitability and managing controllable levers amid external volatility.

Context and Relevance

This is the sharpest January sentiment drop in the Index’s history (since 2005), signalling a break from two decades of New Year optimism among US chief executives. The results matter because CEO confidence influences hiring, capex and investment decisions — and the survey shows a tension: firms are cautious about the macro and political backdrop but still planning growth and hiring in many cases. For executives and investors, the survey is an early indicator of corporate behaviour in 2026.

Why should I read this?

Short version: CEOs are suddenly jittery because of Washington — and that affects hiring, spending and pricing. If your plans hinge on customer demand, borrowing costs or regulatory stability, this is worth five minutes of your time. We’ve done the heavy reading so you can act faster.

Author take

Punchy: This isn’t just a mood swing. A record January drop tied to political uncertainty should sharpen boardroom risk discussions. Expect more focus on margins, selective investment, and contingency planning — while watching capex/headcount signals as the real-world follow-through.