The Inside Edge

Summary

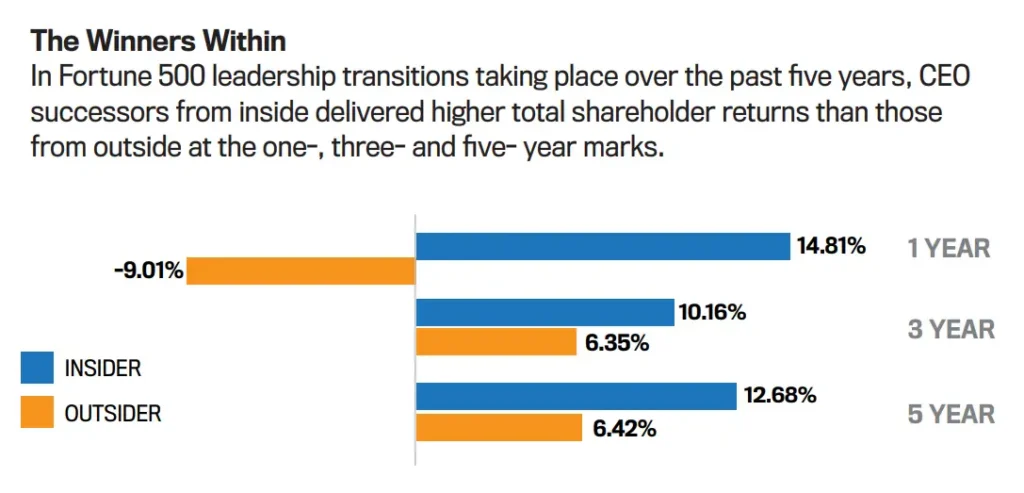

Jeffrey Sonnenfeld (Yale) argues that boards should stop the “messianic” search for external CEO saviours and instead seriously consider internal candidates. New analysis of Fortune 500 CEO transitions over recent years finds that insiders have substantially outperformed outsiders on total shareholder return (TSR). Sonnenfeld highlights multiple examples of successful insiders and lists the practical advantages that internal hires bring to succession.

Key Points

- Recent analysis of Fortune 500 CEO transitions shows internal hires outperform externals on TSR across 1–5 year windows.

- In the past year: 39 internal CEOs averaged a 14.81% annualised TSR versus -9.01% for 22 external CEOs.

- Across 1–3 years and 3–5 years, internal CEO cohorts also delivered materially higher average annualised returns than externals.

- Advantages of insiders include verifiable track records, existing stakeholder relationships, faster ramp-up and reduced risk of misreading internal dynamics.

- Notable successful internal hires cited include Andy Jassy (Amazon), Mary Barra (GM), Bob Iger (Disney) and others across sectors.

Content Summary

Sonnenfeld frames CEO succession as a “make versus buy” decision — a classical strategic trade-off dating back to Peter Drucker. He presents original analysis of Fortune 500 transitions showing a clear pattern: companies that elevated insiders recently saw better stock performance than those that hired outsiders. The article provides specific statistics for one-year, one-to-three-year and three-to-five-year periods to make the case empirically.

Beyond the numbers, Sonnenfeld lists practical reasons internal promotions often work better: boards know insiders’ track records firsthand, insiders can act immediately and are less susceptible to internal flattery, and promoting from within supports morale and signals that leadership development is rewarded. The piece stops short of saying outsiders never make sense, but it urges boards to avoid reflexively seeking an external “saviour”.

Context and Relevance

This analysis matters for boards, CHROs and investors assessing succession strategy. In an era where stability, institutional knowledge and stakeholder relationships are prized, the data suggest boards should prioritise robust internal development pipelines and give serious weight to insider candidates unless there’s a compelling reason for an external hire.

Author style: Punchy — Sonnenfeld blends academic rigour with direct counsel to boards, making the argument both evidence-based and prescriptive.

Why should I read this?

Quick — if you’re involved in succession, HR or sit on a board, this article saves you a bunch of guessing. It’s got hard numbers showing insiders tend to deliver better shareholder returns, plus practical reasons why. Read it to avoid making an expensive hire because someone looks like a miracle fix on paper.