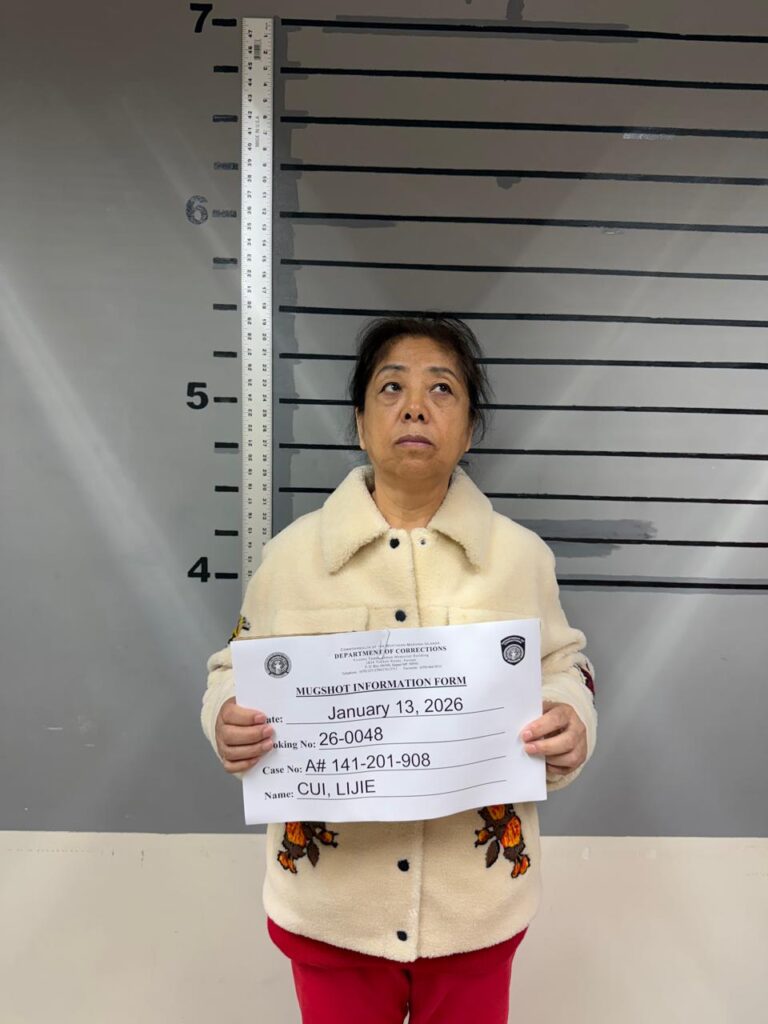

ICE arrests Lijie Cui, controlling shareholder of failed Saipan casino operator

Summary

US Immigration and Customs Enforcement (ICE) detained Lijie Cui, the 68‑year‑old majority shareholder of Imperial Pacific International (IPI), in Saipan and she is being held at a US Department of Corrections facility in Susupe. IPI — once the operator of the now‑defunct Imperial Pacific Palace resort in the Commonwealth of the Northern Mariana Islands — was beset by allegations of money‑laundering, forced labour, unpaid contractors and regulatory breaches before its licence was suspended and the company delisted and entered bankruptcy.

The resort closed in 2020 during the Covid‑19 pandemic, construction stopped in 2021 and the gaming licence was suspended in 2023. IPI filed Chapter 11 in 2024 citing over $165.8m in liabilities, and its assets were sold at auction in 2025 for $12.9m. Authorities have not publicly given a reason for Cui’s arrest; local reporting suggests her long‑term investor visa (E‑2C) in the US jurisdiction may have lapsed. Cui is a Chinese national and Hong Kong resident; a 2018 Forbes profile put her net worth at about $1.1bn and identified her son Ji Xiaobo as central to the Saipan project.

Key Points

- ICE detained Lijie Cui, majority shareholder of Imperial Pacific International, in Saipan; she is held in a US corrections facility.

- Imperial Pacific Palace closed in 2020; the unfinished beachfront resort never reopened and was sold at auction in 2025 for US$12.9m.

- IPI faced long‑running allegations including money‑laundering, forced labour and failure to pay contractors; its gaming licence was suspended in 2023 and it was delisted from the Hong Kong Stock Exchange in 2024.

- IPI filed Chapter 11 bankruptcy in April 2024, listing roughly US$165.8m in liabilities.

- Immigration reasons for Cui’s arrest haven’t been confirmed publicly; local reporting suggests a possible expiry of an investor visa (E‑2C).

Author’s take

Punchy: This is more than a high‑profile detention — it’s the latest twist in a spectacular corporate collapse that raised red flags on regulation, labour practice and AML in a US territory. If you follow gaming, compliance or regional investment risk, the details here matter.

Why should I read this?

Look — this is one of those stories where big money, regulatory failure and alleged criminal activity collide. If you’re tracking risk in gaming, foreign investor rules in US territories, or simply want a neat summary of how a once‑booming VIP casino imploded, this gives you the essentials without wading through court filings.