DExit: Reincorporation Data Seem to Support the Hype

Summary

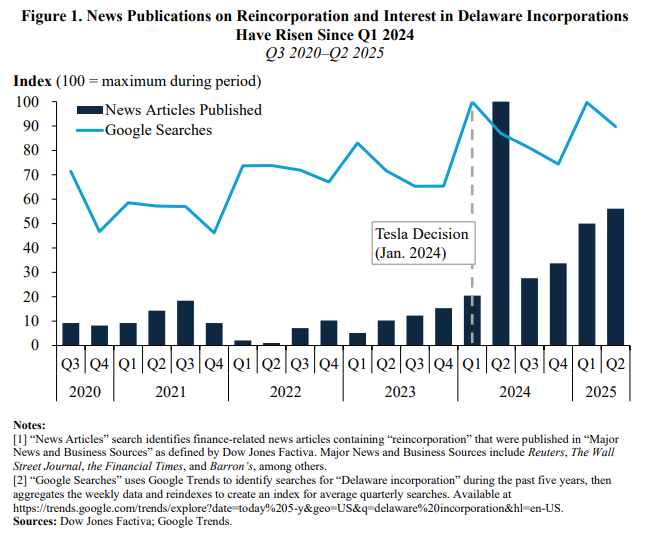

Interest in companies leaving Delaware (“DExit”) surged after the Delaware Court of Chancery invalidated Elon Musk’s Tesla pay package in January 2024, with media coverage and Google searches spiking. Analysis of SEC filings shows a tangible shift: between 2024 and mid‑2025 Delaware experienced a net loss of large public firms by reincorporation (a net loss of 11 firms with market caps > $250m during 2024–2025H1), reversing a net gain in 2022–2023. Many departing firms are “controlled” companies (63% of departures in 2024–2025H1). The main reasons cited by firms that left Delaware are reduced legal exposure, rule‑based governance/greater certainty, and cost savings. Despite this, Delaware still accounts for around 80–90% of IPO incorporations from 2022 to H1 2025, although its share dipped in early 2025. Delaware responded by passing Senate Bill 21 in March 2025 to clarify rules on interested‑party transactions, which may slow departures but the broader impact is uncertain.

Key Points

- Media attention and Google searches about leaving Delaware climbed sharply after the January 2024 Chancery Court decision.

- SEC filing review shows a net loss of 11 large public companies (market cap > $250m) from Delaware during 2024–2025H1.

- Most departing companies in that period were “controlled” firms (largest owner >33% voting power).

- Primary motivations for leaving: reduced legal exposure, governance certainty from statute‑based regimes, and material cost savings.

- Delaware still dominates IPO incorporation (80–90% from 2022–H1 2025), though its share dipped in early 2025.

- Delaware passed SB 21 (March 25, 2025) to clarify insider transaction rules; some firms appear to have paused moves afterward.

- Competition is rising from states such as Nevada and Texas that offer statutory clarity and lower fees for some firms.

Context and Relevance

This analysis turns press noise into data: the spike in stories was not pure hyperbole — there is measurable movement of large public firms away from Delaware since 2024, concentrated among controlled companies. For corporate directors, general counsel and investors, these shifts matter because they affect litigation risk, director duties, corporate cost structures and where case law will develop. SB 21 is Delaware’s legislative response, but whether it restores Delaware’s unchallenged primacy depends on how boards and counsel evaluate legal certainty versus other advantages offered by alternative states.

Why should I read this?

Short version: because this isn’t just clickbait. We read the filings so you don’t have to — and the numbers show actual departures, who’s leaving and why. If you care about governance, litigation risk or where future precedent will be set, this piece saves you time and flags what boards are already worrying about.

Author style

Punchy: data‑driven, no fluff. If you work in corporate governance or advise public companies, consider this required reading — it highlights a possible structural shift that could affect litigation, director recruitment and incorporation decisions.