Best Practices for Corporate Sustainability Teams

Summary

This Conference Board/ESGAUGE study, based on a survey of 70 sustainability and ESG leaders at US and multinational firms, outlines how companies structure sustainability teams, how those teams work with other functions, and which practices improve effectiveness.

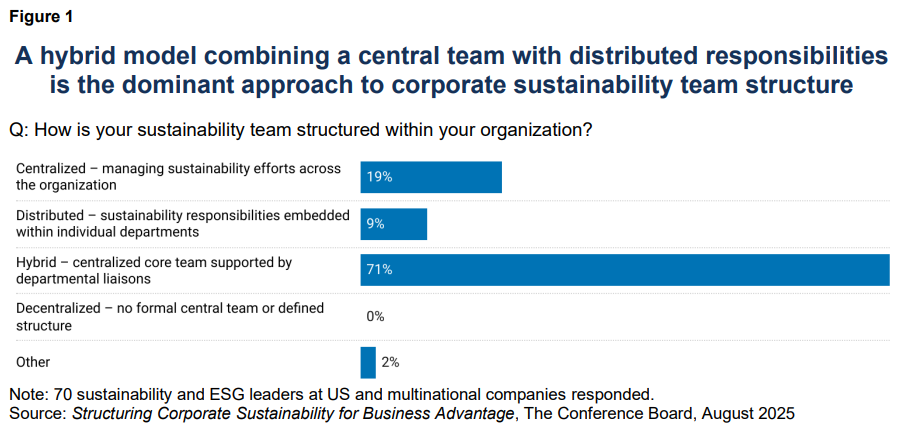

Key findings: most firms prefer a hybrid model (a small central team plus distributed business-unit liaisons); half plan structural tweaks in the next two years to improve coordination and integration; sustainability is embedded in some processes but not enterprise-wide; cross-functional steering committees, KPI alignment, and stronger ties to finance, procurement and risk are top levers; and major talent gaps remain in financial modelling, change management and data analysis.

Key Points

- Hybrid structure is the dominant model — a lean central team (often 1–5 FTEs) paired with embedded departmental liaisons to balance oversight and operational ownership.

- 50% of firms expect to adjust sustainability structures within two years; most changes are minor and focused on integration and coordination rather than wholesale redesign.

- Top integration priorities: finance, procurement/supply chain, risk management, operations, innovation/R&D and legal — with finance gaining prominence due to disclosure demands.

- Cross-functional sustainability steering committees are cited as the single most effective governance mechanism to drive accountability and faster decision-making.

- Tying sustainability to financial and operational KPIs — and embedding related incentives — helps keep ESG goals visibile and actionable across the business.

- Main talent gaps are business-facing capabilities: financial modelling, change management and data analytics; these reflect the shift of sustainability into core strategy and capital allocation.

- Budget constraints: 40% of firms do not plan to add sustainability roles in the next two years, so upskilling and redeployment of existing staff are critical.

- Success requires more than structure: sustained executive sponsorship, deliberate change management and clear communication of the business case are essential to embed sustainability long-term.

Why should I read this?

Quick take: if you work on ESG, risk, finance or operations, this is handy — it tells you what actually works in real companies right now. The report cuts through the buzz and shows practical moves (hybrid teams, steering committees, KPI alignment) that help sustainability stop being a sideline and start shaping decisions. We’ve read it so you don’t have to wade through the full study — focus on the integration and talent bits if you’re short on time.