Macau gaming firms boost non-gaming revenue, but fiscal reliance on casinos remains high: Study

Summary

An academic study from Macao Polytechnic University evaluated the six Macau gaming concessionaires’ social responsibility performance in 2023–2024, focusing on fiscal contributions, employment and non-gaming development. The paper finds that while non-gaming revenue and investment pledges have grown, Macau’s public finances and job market remain heavily dependent on casino activity.

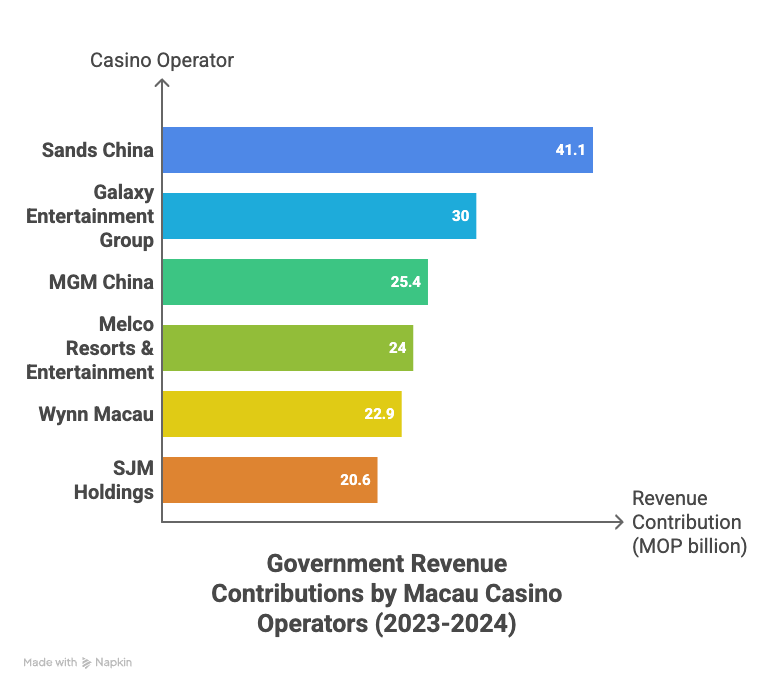

Key figures: the six operators paid a combined MOP164 billion (about US$20.4 billion) in taxes and fees across 2023–24 — roughly 82% of Macau’s recurrent government revenue. Non-gaming revenue for the period was about MOP70.8 billion (US$8.8 billion). The operators employ on average ~78,000 local residents (about 27.3% of Macau’s workforce). Investment commitments under the new concession cycle totalled around MOP140.5 billion (US$17.5 billion), with >90% earmarked for non-gaming projects; about 22% of pledged investment had been completed by end-2024, with variation across firms.

Key Points

- The six concessionaires contributed MOP164 billion (c. US$20.4bn) in taxes/fees in 2023–24 — about 82% of Macau’s recurrent revenue.

- Non-gaming revenue reached MOP70.8 billion (c. US$8.8bn) over 2023–24, led by Sands China (around MOP27.6bn).

- Gaming remains the dominant fiscal and employment pillar: ~78,000 local jobs (27.3% of local workforce) tied to the six operators.

- Operators committed roughly MOP140.5 billion (c. US$17.5bn) in investment for the 10-year concession, with over 90% targeted at non-gaming projects.

- Only ~22% of pledged investment was completed by end-2024; completion rates vary (GEG ~33%, Sands ~25%, Wynn and MGM ~10%).

- Authors warn that rising non-gaming revenue is real but not yet evidence of a fundamental structural shift away from casino dependence.

- Reported investment completion can understate activity because some spending (promotion, events, overseas marketing) isn’t counted as capital expenditure.

Context and relevance

Punchy: If you follow Macau’s economic stability, gaming policy or regional tourism strategy, this study matters. It quantifies just how central casinos remain to Macau’s public finances and employment, even as firms push into MICE, hotels and entertainment. For investors, policymakers and planners, the numbers show progress on diversification but also underline vulnerability: a heavy single-industry fiscal exposure persists.

The study ties into broader trends — post-pandemic recovery, new concession rules that require non-gaming investment, and operators’ strategic pivot to experiences and events. But the research cautions that revenue growth in non-gaming alone doesn’t equal the emergence of independent economic pillars; policymakers should therefore monitor the quality, sustainability and local impact of non-gaming projects, not just headline spend.

Why should I read this?

Short version — because the study tells you exactly how much Macau still needs casinos to keep the lights on, and where operators are (and aren’t) actually delivering on non-gaming promises. It’s a quick way to get the numbers without trawling through filings.