America’s Biggest Bitcoin Miners Are Pivoting to AI

Summary

Major US bitcoin-mining firms are converting large-scale mining facilities into AI and high-performance computing (HPC) data centres as bitcoin profitability falls. Companies including Riot, Bitfarms, Core Scientific, MARA, Cipher Mining and others have announced moves or contracts to host AI workloads. The shift is driven by the halving of mining rewards, a recent drop in bitcoin price and surging, predictable demand from AI companies that want energy- and power-ready facilities. While the pivot promises higher margins and multiyear deals, it also raises technical and grid-reliability challenges — and could reshape where and who mines bitcoin in future.

Key Points

- Several large, publicly traded bitcoin miners are repurposing facilities to host AI and HPC workloads.

- Profitability pressures — a bitcoin halving and a significant price drop — have made traditional mining less attractive.

- AI/HPC contracts deliver steadier revenue and better margins; CoinShares found >$43bn in announced AI/HPC deals by miners.

- Technical hurdles include 24/7 uptime expectations, added backup power and grid-dependant curtailment clauses that miners must overcome.

- Potential systemic consequences: fewer miners could make the bitcoin network more vulnerable or push mining to regions with cheaper energy or sovereign-backed operations.

Content Summary

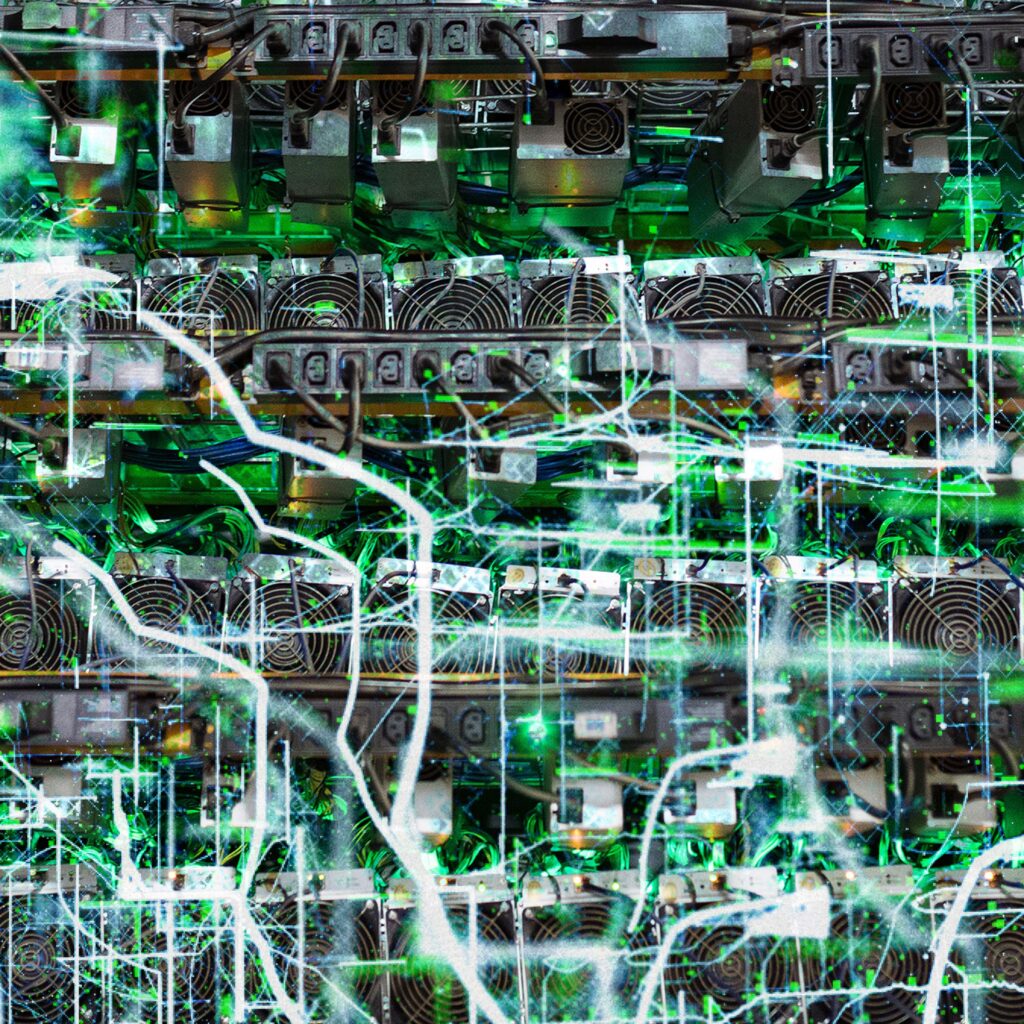

The article opens with Riot Platforms’ Corsicana facility as a case study: originally built as one of the world’s largest bitcoin mines, much of it is now being refitted for AI compute. Over the past 18 months, at least eight sizeable miners announced partial or full pivots to AI. The economics are clear — AI customers offer long-term, predictable contracts and extract more value per unit of energy than bitcoin mining at current prices.

Experts and executives quoted in the piece explain the drivers: rising competition on the bitcoin network, reduced rewards after halvings and a downturn in bitcoin’s price have tightened margins. Conversely, hyperscalers and AI firms need power-dense shells and are willing to sign big deals. Yet miners face real retrofitting costs — guaranteeing near-perfect uptime, adding generators or on-site power, and changing operating agreements with grids.

The article flags longer-term risks for bitcoin: if industrial miners continue to abandon mining, the network’s decentralisation and security could weaken, possibly increasing attack feasibility. Predictions include mining shifting to low-cost-energy jurisdictions, state-backed mining, or a smaller, more specialised group of miners continuing on.

Context and Relevance

This is a cross-industry turning point: infrastructure, energy and finance intersect. For readers tracking AI supply chains, energy markets or crypto resilience, the story explains how capital and capacity are being reallocated from decentralised proof-of-work systems into centralised AI compute. It also highlights policy and grid impacts — where energy availability, regulation and national strategy will influence whether miners stay, pivot or move abroad.

Author note (Punchy)

Punchy take: this is more than companies changing business models — it’s the infrastructure of the AI era being built from bitcoin’s leftovers. If you want to understand where AI compute capacity comes from, and what it costs the power grid and the bitcoin network, read the detail.

Why should I read this?

Short and honest: if you follow AI, crypto or energy, this explains why massive compute capacity is suddenly available and who’s cashing in. It’s basically a map of where the next wave of data-centre capacity is coming from — with some spicy consequences for bitcoin’s future. Read it to save yourself scanning half a dozen earnings calls.

Source

Source: https://www.wired.com/story/bitcoin-miners-pivot-ai-data-centers/