Inside Amazon’s Automation Push: The Next Chapter in Logistics Efficiency and Workforce Transformation

Summary

Amazon is accelerating automation across its fulfilment network, targeting roughly 75 per cent automation of logistics tasks in pursuit of higher throughput, faster delivery and lower unit costs. Internal robotics projections have suggested potential reductions in labour needs — with one estimate flagging about 160,000 jobs at risk globally by 2027 — though Amazon cautions those figures are internal projections and not definitive commitments.

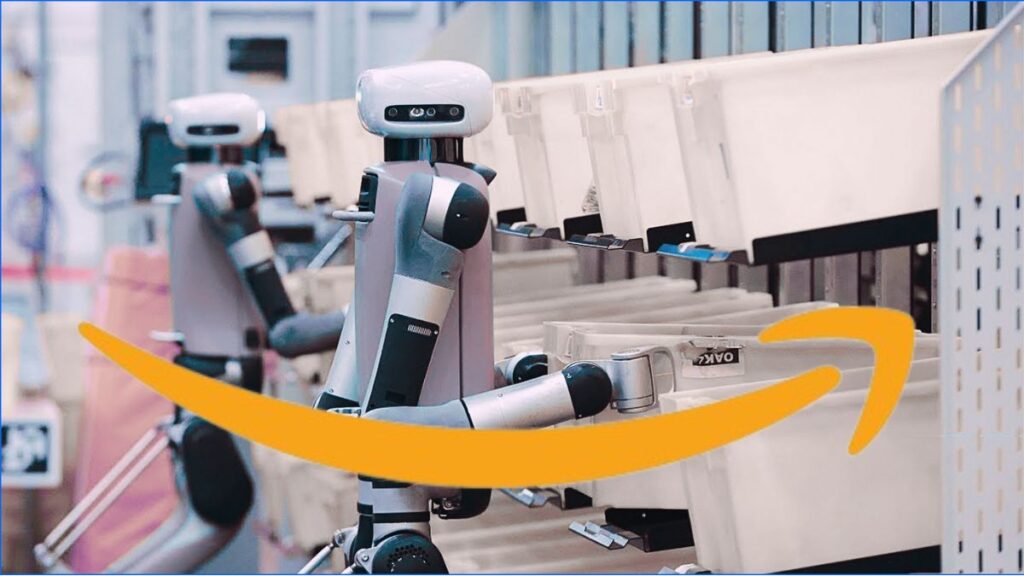

The push changes facility layouts and operating models: fewer manual pickers and more robot-human hybrid systems handling inbound sorting, shelving, picking, packaging and dispatch. Early real-world data show some centres running with around 25 per cent fewer staff where robotics are deployed. The commercial logic is clear — higher capital investment up front for lower variable costs per unit and network optimisation towards larger, more automated centres.

Key Points

- Amazon’s stated objective: bring automation to about 75 per cent of logistics operations — a move driven by throughput, speed and cost imperatives.

- Modelling by Amazon’s robotics unit suggests up to c.160,000 roles could be affected by 2027; Amazon notes these are internal projections, not final decisions.

- Automation impacts the entire fulfilment chain: inbound sorting, shelving, picking, packing and dispatch will shift towards robot-assisted workflows.

- Cost dynamics favour fewer, larger next‑generation fulfilment centres with high automation, despite higher capital costs.

- Workforce demand will pivot from manual pick-pack roles to technician, maintenance, analytics and systems-integration roles — creating urgency for upskilling, especially in labour-heavy markets like India.

Context and Relevance

For supply‑chain managers, logistics providers and policymakers, Amazon’s move is a bellwether. It shows how automation economics are reshaping network design, competitive benchmarks and required skills. In India — where warehousing remains relatively labour‑intensive — the shift signals an urgent need for skill‑development infrastructure, training programmes in robotics and analytics, and policy frameworks that balance capital incentives with human‑capital transition support.

Smaller logistics players should expect mounting pressure on margins as large operators chase sub‑dollar per‑item savings. The strategic choices now include selective automation, process analytics, layout optimisation and investment in a workforce that can manage and maintain automated systems.

Author’s take

Punchy and to the point: this isn’t just a tech project — it’s a sectoral reset. If you manage operations, HR or policy in logistics, you should treat Amazon’s roadmap as a forecast, not an experiment. The detail matters: who you hire, what training you fund and how you redesign your network over the next 3–5 years will determine whether you gain or lose competitive ground.

Why should I read this

Look — if you work in logistics or hire warehouse staff, this one’s worth your five minutes. It explains the likely near‑term changes on the shop floor, shows where jobs will shrink and where new roles will pop up, and tells you the quick wins firms are chasing (faster throughput, lower per‑item cost). In short: it’s the roadmap for where the industry’s headed, and you’ll want to know which side of the fence you’ll be on.