Most Private Companies Now Use LTIs—Here’s How To Get Yours Right

Summary

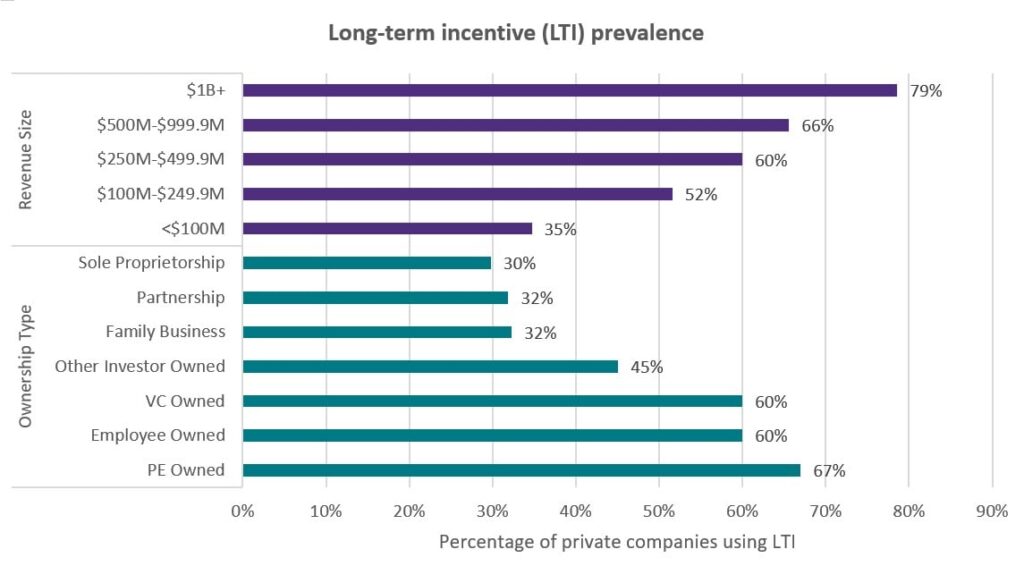

Recent Chief Executive Group research shows formal long-term incentive plans (LTIPs) are now in place at a majority of private U.S. companies with $100m+ revenue, rising to nearly 80% for firms with $1bn+. The article explains why LTIs have spread—particularly in private equity and venture-backed firms—and outlines four board-level debates and three preparatory steps to implement effective LTIs.

Key Points

- LTIPs are majority practice at private companies with $100m+ revenue and very common at $1bn+ firms.

- Ownership type matters: private equity and venture-backed firms favour equity-focused LTIs; family/closely held firms prefer cash or deferred approaches.

- Boards must debate alignment with ownership and strategy, desired behaviours/outcomes, governance/risk controls, and fitting the LTIP to capital strategy.

- Design elements include eligibility, clear performance metrics (EBITDA, revenue, efficiency), payout timing and caps, and clawbacks.

- Recommended 3-step rollout: initiate a diagnostic review, commission benchmarking, and establish a governance roadmap about six months before awards.

Content Summary

The article presents findings from the Chief Executive Group’s CEO & Senior Executive Compensation Report for Private U.S. Companies showing widespread adoption of LTIs among larger private firms. It discusses differences by ownership type—private equity and venture-backed companies use LTIs to drive value ahead of exits, while family-owned firms focus on retention and generational wealth. The authors set out four essential conversations that boards must have: alignment with ownership and strategy; the behaviours and outcomes LTIs should incentivise; governance to control risk and ensure fairness; and tailoring structures to fit capital strategies. They advise three preparatory steps—diagnostic, benchmarking and governance roadmap—to prepare for a successful LTIP rollout within the next fiscal year.

Context and Relevance

As retention risks rise and competition for senior talent intensifies, LTIs have become a strategic tool for private companies to align executive incentives with long-term value creation. The guidance is timely for CEOs, compensation committees and boards designing programmes that must balance motivation, fairness and risk while reflecting ownership and exit horizons.

Why should I read this?

Look, if you’re worried about losing top people or getting your exec pay to actually move the needle, this is a quick, practical read. It tells you the key board conversations, what to watch for in plan design, and three concrete steps to get a robust LTIP ready without reinventing the wheel.

Source

Source: https://chiefexecutive.net/most-private-companies-now-use-ltis-heres-how-to-get-yours-right/